okatiev.ru

Learn

Cup And Handle Pattern

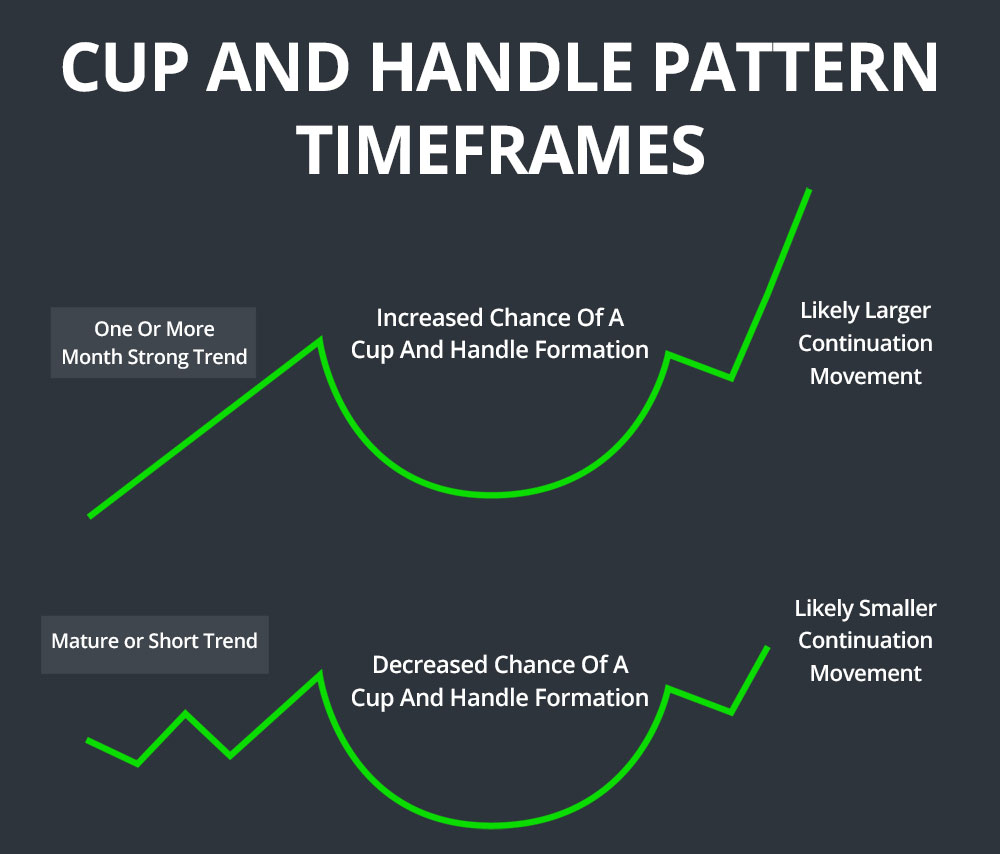

In the domain of technical analysis of market prices, a cup and handle or cup with handle formation is a chart pattern consisting of a drop in the price and. This study identifies cup with handle patterns on a chart. This pattern can be considered either a trend continuation or trend reversal pattern. The cup part of the pattern should be fairly shallow, with a rounded or flat "bottom" (not a V-shaped one), and ideally reach to the same price at the upper end. Long-term trend: The cup and handle pattern often signals a continuation of a bullish trend. It's especially reliable when it forms during an uptrend. Stock Screen: This finds which have formed Cup-with-Handle patterns which are at least 8 weeks long and at most 9 months long. The beginning, or left side. Stage 1: Setup. The pattern starts with a stock rising from a former base. At some point, profit taking sets-in and the stock begins to decline, ending the. The “Cup and Handle” pattern in technical analysis is characterized by a rounded 'cup' followed by a handle or narrow trading range. This type of. A cup and handle is a technical analysis pattern that appears on a chart as a U-shaped pattern, followed by a small downward drift, resembling a handle. Cup and handle patterns are formed when there is a sharp price rise, followed by a fall. Learn more about cup and handle patterns and how to trade them. In the domain of technical analysis of market prices, a cup and handle or cup with handle formation is a chart pattern consisting of a drop in the price and. This study identifies cup with handle patterns on a chart. This pattern can be considered either a trend continuation or trend reversal pattern. The cup part of the pattern should be fairly shallow, with a rounded or flat "bottom" (not a V-shaped one), and ideally reach to the same price at the upper end. Long-term trend: The cup and handle pattern often signals a continuation of a bullish trend. It's especially reliable when it forms during an uptrend. Stock Screen: This finds which have formed Cup-with-Handle patterns which are at least 8 weeks long and at most 9 months long. The beginning, or left side. Stage 1: Setup. The pattern starts with a stock rising from a former base. At some point, profit taking sets-in and the stock begins to decline, ending the. The “Cup and Handle” pattern in technical analysis is characterized by a rounded 'cup' followed by a handle or narrow trading range. This type of. A cup and handle is a technical analysis pattern that appears on a chart as a U-shaped pattern, followed by a small downward drift, resembling a handle. Cup and handle patterns are formed when there is a sharp price rise, followed by a fall. Learn more about cup and handle patterns and how to trade them.

The cup and handle is a longer term continuation pattern, normally observed on weekly charts. The cup and handle forms as an intermediate/secondary cycle. A Cup and Handle is a bullish continuation chart pattern that marks a consolidation period followed by a breakout. Chart patterns form when the price of an. Inverted Cup and Handle Pattern Meaning. An inverted cup and handle pattern consists of several candlesticks that form an upside-down u formation. At the base. What Is A Cup And Handle Chart Pattern? It is a pattern based on mass psychological principles with the following 6 characteristics and 4 distinct phases. The Cup and Handle pattern is a bullish continuation pattern that occurs during an uptrend. It consists of a “cup” formation, followed by a “handle” formation. I gave it a brief look. It certainly shows a C&H pattern. However, IME those patterns are most successful when they are formed after long-term. Bullish Cup-and-Handle Search Engine by Tickeron. Our Pattern Recognition Scanner Helps You to Automatically Find Stock Trading Patterns. The cup and handle pattern is one of the oldest chart patterns you will find in technical analysis. In my experience, it's also one of the more reliable. The cup and handle is a longer term continuation pattern, normally observed on weekly charts. The cup and handle forms as an intermediate/secondary cycle. The cup and handle pattern is a bullish continuation pattern used in technical analysis to identify potential buying opportunities in the market. It. A cup-and-handle chart pattern resembles a cup of tea. These are bullish continuation patterns where the growth has paused. momentarily, it trades down and. A cup-and-handle chart pattern resembles a cup of tea. These are bullish continuation patterns where the growth has paused. momentarily, it trades down and. The Cup and Handle pattern occurs during an uptrend. It is a bullish continuation pattern. The formation resembles a teacup with a handle where the Cup is in. The cup itself comprises the largest part, this is the base U-shape formed by a double price top acting as a resistance level. To its right, the handle is. The Cup is usually U-shape and the handle is basically the retracement from the prior top to about 1/3rd of the vertical height of the cup and looks quite. Cup and handles are two part patterns that start with a peak that sells off and forms a rounding U shape recovery back to the prior high where the sell-off. Cup and Handle chart pattern formation - bullish or bearish technical analysis reversal or continuation trend figure. Vector stock, cryptocurrency graph. Cup and handle pattern is formed when there is an uptrending bullish pattern that touches near its previous highs. It indicates that the stock patterns go. A cup and handle pattern is considered a bullish signal extending an uptrend in the stock market and is used to discover the opportunities to go long. Along. A cup and handle pattern is a signal that indicates a bullish pattern is emerging for a security. Learn more about how they work here.

Average Metal Roof Cost

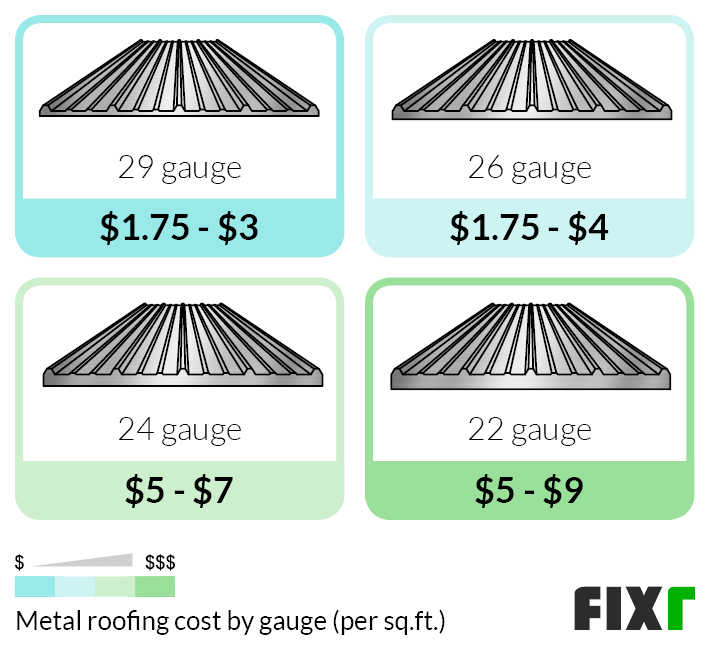

Although the answer to this question will vary, in general, you can count on a metal roof to cost anywhere between $5 to $14 per square foot. This means that a. Metal roofs are superior to asphalts and usually, that quality transfers to a higher price. To install a metal roof, it costs on average anywhere from $5, to. The cost of steel metal panels ranges from $ $ per square foot. Below is a chart with the price ranges for each fastener system type based on paint. You will pay between $ and $ per square foot for metal roofing materials and installation. Corrugated Metal. If you're looking to keep costs down. On average, homeowners can expect to pay between $ – $ per square foot on their metal roof plus labour fees, the price is depending on the quality of. Aluminum standing seam metal roofs cost between $14 and $16 per roof square while steel standing seam metal roofs cost between $12 and $14 per roof square. The. 4. Terne Metal Roofing: Classic 'Tin Roof' Charm · Average Cost: $ to $ per square foot. · Typical Cost: For a 3,square-foot home, the cost ranges. A metal roof can cost anywhere from $ to $, depending on size, material, and type. A basic, square-foot standing seam metal roof can cost. The cost of installing a new metal roof in Pittsburgh on average is about $ but can normally range anywhere from $ to $ Although the answer to this question will vary, in general, you can count on a metal roof to cost anywhere between $5 to $14 per square foot. This means that a. Metal roofs are superior to asphalts and usually, that quality transfers to a higher price. To install a metal roof, it costs on average anywhere from $5, to. The cost of steel metal panels ranges from $ $ per square foot. Below is a chart with the price ranges for each fastener system type based on paint. You will pay between $ and $ per square foot for metal roofing materials and installation. Corrugated Metal. If you're looking to keep costs down. On average, homeowners can expect to pay between $ – $ per square foot on their metal roof plus labour fees, the price is depending on the quality of. Aluminum standing seam metal roofs cost between $14 and $16 per roof square while steel standing seam metal roofs cost between $12 and $14 per roof square. The. 4. Terne Metal Roofing: Classic 'Tin Roof' Charm · Average Cost: $ to $ per square foot. · Typical Cost: For a 3,square-foot home, the cost ranges. A metal roof can cost anywhere from $ to $, depending on size, material, and type. A basic, square-foot standing seam metal roof can cost. The cost of installing a new metal roof in Pittsburgh on average is about $ but can normally range anywhere from $ to $

Average Metal Roof Costs · Steel: $ to $4 · Aluminum: $ to $ · Copper: $13 to $25 · Zinc: $13 to $25 · Tin: $ to $ The average cost of a budget-friendly metal roof ranges from $3, to $9, This budget would include a roof for a modest-sized home with minimal pitch and a. If you opt for a standing seam metal roof, the cost could be higher, ranging from $12, to $21,, given the average cost of $8 to $14 per square foot. Metal. On average, metal roof installation costs range from $ to $ per Doing so will help you get a better understanding of the total cost of your metal roof. Average total costs for a roof on a square foot house generally range from $14, to $25, Choose the type of materials you want for. In Tampa Bay, the average metal roof cost can range from $5, to $35, that's about $5 to $20 per square foot. For a regular 1, square-foot. The cost of installing a new metal roof in Spokane can range anywhere from $ to $ depending on the size of your rooftop. The average cost of a tin roof is $3 to $15 per square foot. Zinc Metal Roofing. Consider zinc if you want a high-quality metal roof that's more durable than. The most expensive roofing material is metal, with an average cost of $ per square foot. Despite its higher cost, opting for metal roofing offers a host of. From doing it yourself to hiring a full-service, well-equipped roof contractor the installation prices can range from nothing to over $15 a square foot. Full. The average cost for a new metal roof in Houston is around $17, Roof Size Impacts the Cost of New Metal Roof Installation. The size of your roof will be the. Average Cost of Metal Roofs in Ottawa. FACT -OVER JUST one SHINGLE REPLACEMENT, metal roofs cost 30%% less than ASPHALT . AVERAGE METAL ROOF COST. Currently, residential & light commercial metal roofing products can range in their cost anywhere from $ to $ per square foot. In roofing terms, expect. According to this article in Forbes magazine, looking at the national metal roofing market, they note that the average metal roofing costs can vary between $5. 1) Type of Metal · Galvanized steel: $8-$14 per sq. ft. · Aluminum: $4-$12 per sq. ft. · Corrugated metal: $3-$7 per sq. ft. · Tin: $3-$5 per sq. ft. · Copper. In August the cost to Install a Seam Metal Roof starts at $ - $ per square foot*. Use our Cost Calculator for cost estimate examples customized. While metal roofs do have a higher initial price tag, ranging from $5 to $16 per square foot as opposed to $3 to $5 for asphalt shingles, they offer unmatched. Calculating for the national average roof size of 1, square feet, causing a new metal roof will run you an average cost between $15, on the low end and. The average price for aluminum metal roofing is between $ and $ per square foot. Steel Metal Roof Cost. up close photo of a red standing seam roof. Average cost of a metal roof ranges from $6 to $14 per square foot (installed). Free Quotes from Metal Roof Contractors. Find metal roof contractors in just

Pip Personal Injury Protection

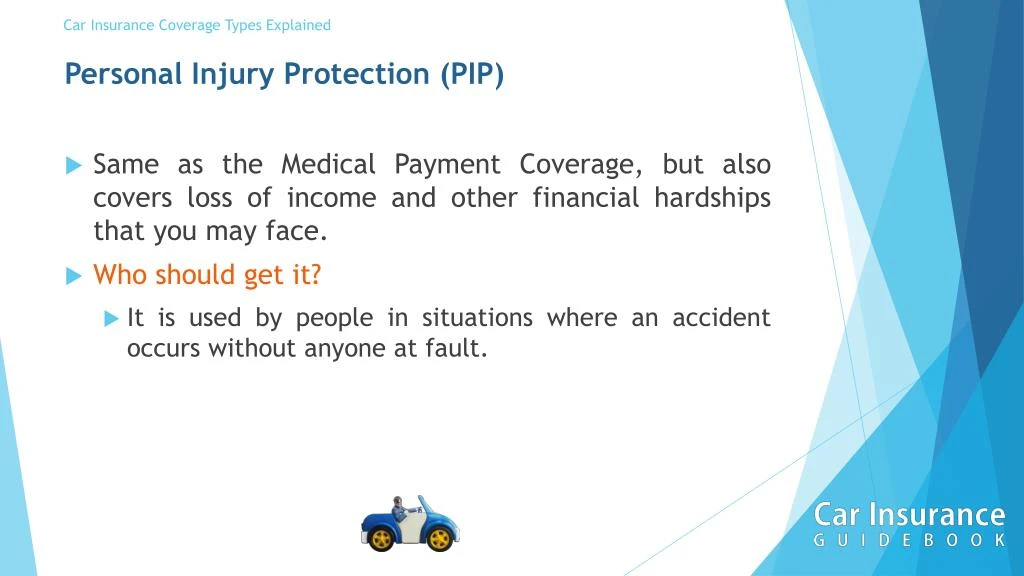

Personal injury protection (PIP) for car insurance covers medical expenses and, if applicable, lost wages, regardless of who is at fault in an auto. PIP will pay these benefits after your deductible is reached. PIP will pay up to $10, total, although it is possible to pay for extra coverage. That $10, Personal injury protection (PIP) is an extension of car insurance available in some US states that covers medical expenses and, in some cases, lost wages and. This insurance is there to compensate you for any lost wages and healthcare bills in the event of a car accident. In most US states, obtaining PIP insurance is. The Florida PIP insurance attorneys at Ged Lawyers specialize in handling PIP claims in Florida and have a track record of successfully recovering millions of. PIP insurance takes collections away from the tort system to limit litigation and to reduce the caseload that courts must handle. Find out more. The PIP insurer will pay up to $10, in collision-related medical expenses for up to three years. The coverage applies to each person in the insured vehicle. Personal injury protection (PIP) is an extension of car insurance available in some U.S. states that covers medical expenses and, in some cases. PIP, or "no fault" insurance, helps pay for medical bills, lost income, and childcare if you or your passengers are injured in an accident, regardless of. Personal injury protection (PIP) for car insurance covers medical expenses and, if applicable, lost wages, regardless of who is at fault in an auto. PIP will pay these benefits after your deductible is reached. PIP will pay up to $10, total, although it is possible to pay for extra coverage. That $10, Personal injury protection (PIP) is an extension of car insurance available in some US states that covers medical expenses and, in some cases, lost wages and. This insurance is there to compensate you for any lost wages and healthcare bills in the event of a car accident. In most US states, obtaining PIP insurance is. The Florida PIP insurance attorneys at Ged Lawyers specialize in handling PIP claims in Florida and have a track record of successfully recovering millions of. PIP insurance takes collections away from the tort system to limit litigation and to reduce the caseload that courts must handle. Find out more. The PIP insurer will pay up to $10, in collision-related medical expenses for up to three years. The coverage applies to each person in the insured vehicle. Personal injury protection (PIP) is an extension of car insurance available in some U.S. states that covers medical expenses and, in some cases. PIP, or "no fault" insurance, helps pay for medical bills, lost income, and childcare if you or your passengers are injured in an accident, regardless of.

Personal injury protection, or PIP as it's commonly known, is a form of car insurance that can help cover the costs of medical bills, lost income and essential. What Does PIP Insurance Cover? Personal injury protection insurance is a type of no-fault coverage. It reimburses a driver and his or her passengers for their. Discover the comprehensive coverage and benefits of PIP in auto insurance. PIP is typically very simple—the application must be filled out and submitted, and copies of related medical bills (and sometimes records) must be provided. If. Personal injury protection, also known as PIP coverage or no-fault insurance, covers medical expenses regardless of who's at fault. Personal injury protection (PIP) insurance, also known as no-fault insurance, provides coverage for you — and those insured on your policy — for medical. What is PIP? PIP is an optional coverage that can be added to your auto insurance policy. If you're in an auto accident, it can help pay for: PIP applies no. Personal Injury Protection (PIP) PIP, or Personal Injury Protection, is a form of auto insurance that is mandatory for New York drivers. PIP is not liability. What is PIP coverage? Personal Injury Protection insurance (usually shortened to PIP insurance) is auto insurance coverage that can help pay your medical. Both personal injury protection (PIP) and bodily injury (BI) pay for medical bills and expenses resulting from an accident, but they differ depending on where. Is PIP Insurance Coverage Limited? New York requires car owners to carry a minimum of $50, per person in PIP coverage. These benefits will also coordinate. Personal injury protection, also known as PIP insurance, can help defray such costs and even help protect your friends and family after a covered accident. PIP stands for personal injury protection, and it covers medical expenses – possibly including work-loss coverage – for you and your passengers after a. The primary difference between personal injury protection (PIP) and bodily injury (BI) is that while there is no degree of “at-fault” needed for filing PIP. Personal injury protection (PIP) coverage, or “no fault” insurance helps pay fo expenses after a car collision, regardless of who was at fault. It covers medical expenses and things like lost wages and household services if you can't work. PIP also covers the other drivers on your policy and accidents. What Is PIP? Personal injury protection is available to Florida policyholders who suffer injuries after a collision. Benefits are payable to the policyholder. Personal Injury Protection (PIP) pays if you or other persons covered under your policy are injured in an auto accident. It is sometimes called “no-fault”. Personal Injury Protection, also known as PIP insurance, helps to pay for your (or your passengers') medical expenses from an auto accident—regardless of if the. Personal injury protection, often called PIP insurance, is a type of auto insurance coverage that can help cover your medical and other expenses that result.

How Do You Trade Forex

We'll break down the essential concepts and guide you through the most critical steps, from choosing a broker and placing your first trade to developing a. Forex traders can make money by correctly speculating on the movement of currency exchange rates. This can happen in various ways, such as by buying a currency. When you trade forex, you're buying or selling a currency pair – such as EUR/USD, GBP/USD or USD/JPY. Let's take a closer look at the anatomy of forex pairs. What Is Forex Trading? With innovative investment tools and a collaborative trading community, eToro empowers millions of users in over countries to trade. The keys to success in forex trading include not just a good, sound trading strategy, but exceptional trading discipline, patience, and risk management. Here are some secrets to winning forex trading – five tips to help make your trading more profitable and your career as a trader more successful. Preparing for Your First Forex Trade · Step 1: Learn About the Forex Market · Step 2: Choose How You Want to Trade Forex · Step 3: Choose a Broker · Step 4. Forex trading, also known as foreign exchange or FX trading, is the conversion of one currency into another. You're always trading one currency against another, such as the US dollar against the Canadian dollar (USD/CAD). This is called a forex pair. We'll break down the essential concepts and guide you through the most critical steps, from choosing a broker and placing your first trade to developing a. Forex traders can make money by correctly speculating on the movement of currency exchange rates. This can happen in various ways, such as by buying a currency. When you trade forex, you're buying or selling a currency pair – such as EUR/USD, GBP/USD or USD/JPY. Let's take a closer look at the anatomy of forex pairs. What Is Forex Trading? With innovative investment tools and a collaborative trading community, eToro empowers millions of users in over countries to trade. The keys to success in forex trading include not just a good, sound trading strategy, but exceptional trading discipline, patience, and risk management. Here are some secrets to winning forex trading – five tips to help make your trading more profitable and your career as a trader more successful. Preparing for Your First Forex Trade · Step 1: Learn About the Forex Market · Step 2: Choose How You Want to Trade Forex · Step 3: Choose a Broker · Step 4. Forex trading, also known as foreign exchange or FX trading, is the conversion of one currency into another. You're always trading one currency against another, such as the US dollar against the Canadian dollar (USD/CAD). This is called a forex pair.

The most popular ones are retail forex, spot FX, currency futures, currency options, currency exchange-traded funds (or ETFs), forex CFDs, and forex spread. Customer Advisory: Eight Things You Should Know Before Trading Forex · You are trading against the dealer. · Two out of three forex customers lose money. · The. The aim is to buy a currency pair at a lower price and sell it at a higher price (or vice versa) to generate a profit. Forex trading is conducted electronically. Forex trading involves the purchase and sale of currency pairs, such as EUR/USD or JPY/GBP, as opposed to other securities like stocks. To trade both futures and forex, a trader needs to have a qualified account. It's possible to apply to trade futures and forex through a client's okatiev.ru Forex traders (foreign exchange traders) anticipate changes in currency prices and take trading positions in currency pairs on the foreign exchange market. Forex is flexible. It offers the ability to control your investment schedule. You can conduct your trading at any time of the day or night. We've broken forex trading down into some simple steps to help you get started. 1. Decide how you'd like to trade forex. Start trading with No. 1 forex broker in the US*. Our award-winning online forex trading platforms and apps are available on web, desktop and mobile. The foreign exchange market (also called forex or FX) refers to the over-the-counter (OTC) electronic networks where currencies are traded. Base and Quote Currency. Whenever you have an open position in forex trading, you are exchanging one currency for another. Currencies are quoted in relation to. You'll discover that you can choose between many different currency pairs – from majors to exotics – and trade 24 hours a day. Find out how to trade forex online today with this step-by-step guide – including information on how currency trading works and how to open your first position. The best strategies as a beginners are day trading, swing trading, scalping and position trading. Most forex transactions are carried out by banks or individuals by seeking to buy a currency that will increase in value against the currency they sell. However. To trade forex, you must have a brokerage account that is approved for forex trading. Log in to apply for forex approval. Forex trading is the process of buying and selling international currencies with the objective of making a profit from fluctuations in the exchange rates. 'Forex' is short for foreign exchange, also known as FX or the currency market. It is the world's largest form of exchange, trading around $4 trillion every. 1. Know the markets. We cannot overstate the importance of educating yourself on the forex market. Take the time to study currency pairs and what affects them. Forex trading allows for round-the-clock trading in various global sessions, distinct from stock markets that operate through central exchanges. This means you.

Front Load Mutual Fund

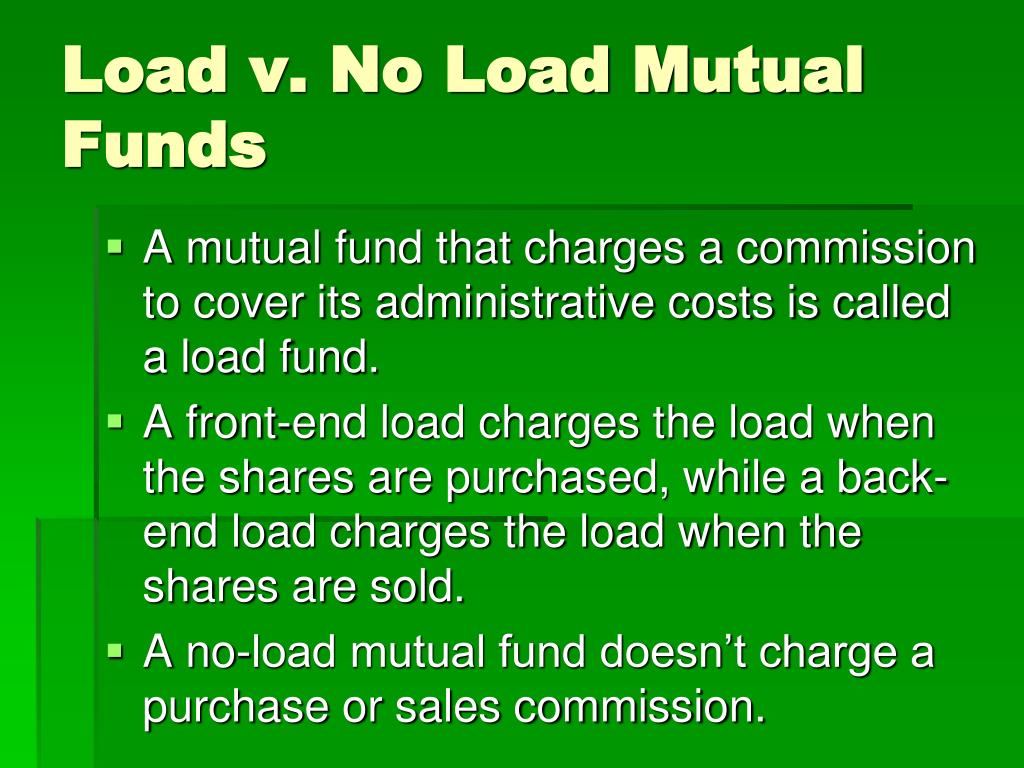

A front loaded mutual fund is simply a fund that charges a one-time fee upon the purchase of shares of the fund. These are called Class A shares. load mutual funds run by seasoned stock pickers. This May, the fund will change its name to Nuveen Core Impact Bond and start charging a % front-end load. A front-end load mutual fund must have at least some performance advantage, however slight or subtle, or else it wouldn't be offered by anyone in the first. Breakpoint discounts are volume discounts to the front-end sales load charged to investors who purchase Class A mutual fund shares. Vanguard funds never charge front-end or back-end loads. And you trade thousands of ETFs and mutual funds from Vanguard and other companies commission free. If you invest $10, and the front load commission you negotiated with your advisor is 2% ($),. $9, will go into the investment and $ will go to your. Class A shares charge investors a front-end load sales commission, typically ranging between %% of the initial investment. A front-end load is a fee charged to investors when they buy mutual fund shares. This fee is typically a percentage of the investment amount. A sales charge on purchase, sometimes called a "load", is a charge you pay when you buy shares. It is sometimes referred to as the front-end load. You can. A front loaded mutual fund is simply a fund that charges a one-time fee upon the purchase of shares of the fund. These are called Class A shares. load mutual funds run by seasoned stock pickers. This May, the fund will change its name to Nuveen Core Impact Bond and start charging a % front-end load. A front-end load mutual fund must have at least some performance advantage, however slight or subtle, or else it wouldn't be offered by anyone in the first. Breakpoint discounts are volume discounts to the front-end sales load charged to investors who purchase Class A mutual fund shares. Vanguard funds never charge front-end or back-end loads. And you trade thousands of ETFs and mutual funds from Vanguard and other companies commission free. If you invest $10, and the front load commission you negotiated with your advisor is 2% ($),. $9, will go into the investment and $ will go to your. Class A shares charge investors a front-end load sales commission, typically ranging between %% of the initial investment. A front-end load is a fee charged to investors when they buy mutual fund shares. This fee is typically a percentage of the investment amount. A sales charge on purchase, sometimes called a "load", is a charge you pay when you buy shares. It is sometimes referred to as the front-end load. You can.

To simplify the meaning of front-end load, one can state that it is the upfront fees paid for purchasing that particular investment tool. A front-end load is. A back-end load is a nominal percentage that goes as the sales charge paid to the brokers in an agreed time, mostly five to ten years. Investor A Shares—Purchased with varying initial sales charges, depending on the fund and investment amount, and provide up-front commissions and ongoing. There are two general types of sales loads. If a sales load is required at purchase, it is called a “front-end” sales load; if it is charged when shares are. There are 2 general types of sales loads—a front-end sales load investors pay when they purchase fund shares and a back-end, or deferred, sales load investors. Front-end and back-end loads are neither part of a mutual fund's operating expenses, however level-loads, called 12b-1 fees will be included. The annals show. This is a charge paid when shares are acquired. Also known as a front-end load, this charge typically is distributed to the brokers that sell the fund's shares. Mutual fund loads can be charged in three ways: Front-end loads (Class A shares) charge investors when they initially make an investment. Back-end. When you purchase shares in a mutual fund and pay a sales charge at that time, you are paying a front-end load. This type of charge reduces the amount of. Investor A Shares—Purchased with varying initial sales charges, depending on the fund and investment amount, and provide up-front commissions and ongoing. An upfront sales charge investors pay when they buy fund shares. It generally is used by the fund to compensate brokers. A front-end load is deducted from the. A load fund is a mutual fund that comes with a larger amount of commissions and fees. The fees are paid by the investor and go towards paying the financial. There are two general types of sales loads. If a sales load is required at purchase, it is called a “front-end” sales load; if it is charged when shares are. Mutual fund loads can be charged in three ways: Front-end loads (Class A shares) charge investors when they initially make an investment. Back-end. Common share classes are A (front-end load), B (deferred fees), C (no sales charge and a relatively high annual 12b-1 fee). Multi-class funds hold the same. A front-end load, or sales charge, is a fee investor pay when purchasing mutual funds or other investment products. Some mutual funds charge you when you buy your units or shares (called front-end load or initial sales charge) and others charge you when you sell (called back-. Front End Load: A commission or sales charge applied at the time of the initial purchase for an investment, usually mutual funds and insurance policies. The category "Sales Charge (Load) on Purchases" in the fee table includes sales loads that investors pay when they purchase fund shares (also known as front-end. The SEC does not limit the size of a sales load a fund may charge, but the NASD does not permit mutual fund sales loads to exceed %. The percentage is lower.

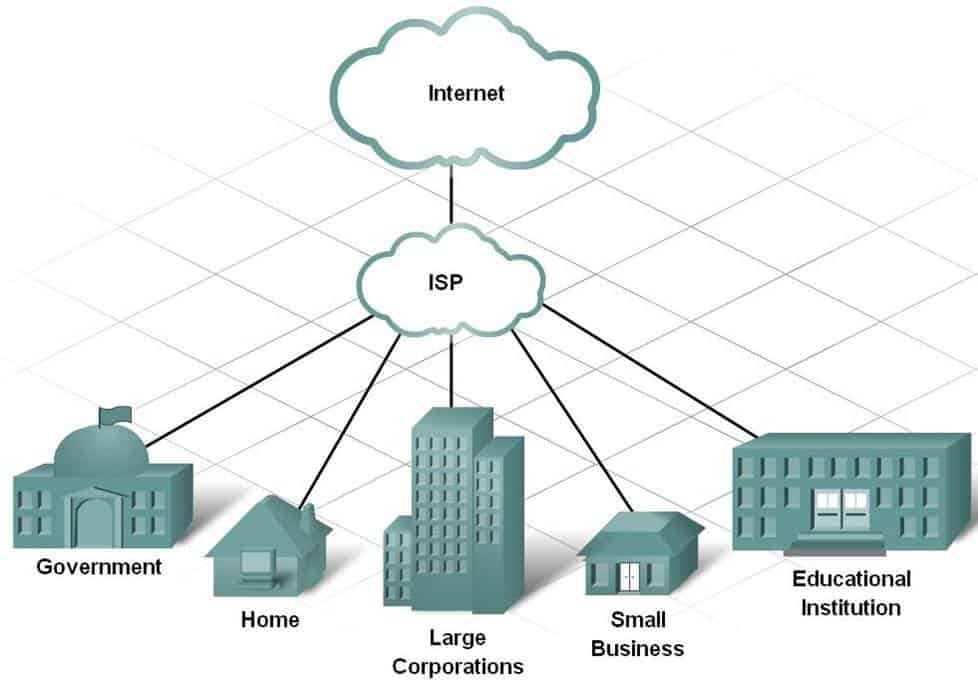

What Is A Isp Provider

ISP is an acronym that stands for Internet Service Provider. An Internet Service Provider is a company that provides Internet access to organizations and home. An ISP, or Internet Service Provider, is a company that provides customers with access to the Internet. They do this by providing a connection. An Internet service provider (ISP) is an organization that provides myriad services related to accessing, using, managing, or participating in the Internet. Internet service providers (ISP) are responsible for making internet service in the home popular and accessible. My ISP - Check Who Is My ISP. Our ISP Lookup tool finds your internet service provider (ISP) & displays the information about it accurately. It also provides. A wireless internet service provider (WISP) is an internet service provider (ISP) that allows subscribers to connect to the internet at designated hot spots or. Your Internet Service Provider (ISP) is the company that provides your internet access. Examples of ISPs are: Visit okatiev.ru to look for your ISP. An internet service provider, or ISP, is the industry term for a company that provides access to the internet. Some nationally recognized ISPs include AT&T. ISP stands for Internet Service Provider, which is a company that provides you with Internet access, usually through a dial-up, DSL, or broadband connection. ISP is an acronym that stands for Internet Service Provider. An Internet Service Provider is a company that provides Internet access to organizations and home. An ISP, or Internet Service Provider, is a company that provides customers with access to the Internet. They do this by providing a connection. An Internet service provider (ISP) is an organization that provides myriad services related to accessing, using, managing, or participating in the Internet. Internet service providers (ISP) are responsible for making internet service in the home popular and accessible. My ISP - Check Who Is My ISP. Our ISP Lookup tool finds your internet service provider (ISP) & displays the information about it accurately. It also provides. A wireless internet service provider (WISP) is an internet service provider (ISP) that allows subscribers to connect to the internet at designated hot spots or. Your Internet Service Provider (ISP) is the company that provides your internet access. Examples of ISPs are: Visit okatiev.ru to look for your ISP. An internet service provider, or ISP, is the industry term for a company that provides access to the internet. Some nationally recognized ISPs include AT&T. ISP stands for Internet Service Provider, which is a company that provides you with Internet access, usually through a dial-up, DSL, or broadband connection.

An internet service provider (ISP) is a business that provides services to access, use or participate in the internet. Internet Service Provider ISP is a business that provides internet services to the public. ISP services can be accessed through various mediums such as. It stands for Internet Service Provider – a company that gives you access to the Internet. Sometimes people confuse Mailbox Providers with ISP because internet. Different types of ISP connections · DSL (digital subscriber line) · cable broadband · fibre optic broadband · wireless or Wi-Fi broadband · satellite and. An ISP, or internet service provider, is a company that lets you access the internet from home, usually with a monthly subscription. Our ratings of best internet providers help you find the best ISPs in your area. We also rate and review the fastest and the cheapest internet plans. An ISP (internet service provider) is a company that provides individuals and organizations access to the internet and other related services. An ISP has the. How to start an ISP. Your best option for an ISP start-up is to create a regional wireless internet service provider, also known as a WISP. These types of. Internet service providers (ISP) are responsible for making internet service in the home popular and accessible. Internet Service Providers, commonly referred to as ISPs, are organisations that provide connectivity to the Internet. Examples of ISPs include Vodafone. A company that provides Internet access to its customers. The majority of ISPs are too small to purchase access directly from the network access point (NAP). An internet service provider (ISP) is a company that provides internet access. Learn about ISP services and how to choose the best provider for your. Your Internet Service Provider (ISP) establishes the internet in your home. This initial connection allows your modem to translate internet traffic. Different types of ISP connections · DSL (digital subscriber line) · cable broadband · fibre optic broadband · wireless or Wi-Fi broadband · satellite and. Federal Regulation of ISPs. At the federal level, ISPs are regulated by the FCC, the agency with jurisdiction over "all interstate and foreign communications by. Our ratings of best internet providers help you find the best ISPs in your area. We also rate and review the fastest and the cheapest internet plans. Identity Service Provider (ISP) Definitions: A trusted entity that issues or registers subscriber authenticators and issues electronic credentials to. The acronym ISP refers to an internet service provider, or company that provides other companies, families, and mobile users with access to the internet. ISP (internet service provider) is a company that provides web access to customers. ISPs allow their business and personal users to go online, surf the web.

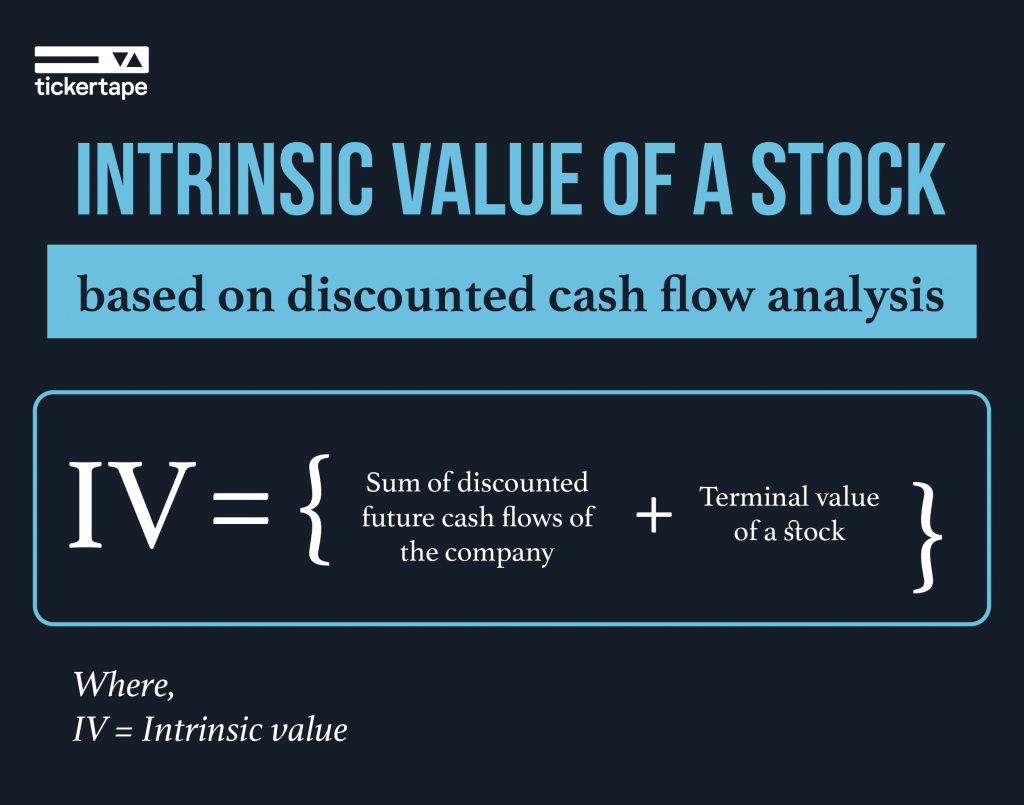

High Intrinsic Value Stocks

Stock intrinsic value is the real worth of a company's stock, based on its financial health and performance. Instead of looking at the stock's current market. Just as the intrinsic value of a business tells how much it would be worth if it were to liquidate and sell everything, the intrinsic value of a share tells. To answer your question, I find Morningstar to be a decent source that can help analyze stocks, it condenses information pretty well. Intrinsic value is the anticipated or calculated value of a company, stock, currency or product determined through fundamental analysis. But what if the strike price is higher than the $ market price of XYZ stock? Let's say the call option strike is $50 ($48 – $50 = –$ The option would. In intrinsic valuation, the value of an asset is estimated based upon its cash flows, growth potential and risk. In its most common form, we use the discounted. If the stock price is higher than the intrinsic value, it may be overpriced and not worth buying (but potentially worth shorting). If the stock is trading. We view intrinsic value as an estimate of what a company is worth today based on expectations of its future growth. The goal is to identify stocks with. Intrinsic value is a measure of what a stock is worth, independent of its current market price. It represents the perceived true value of the stock based on an. Stock intrinsic value is the real worth of a company's stock, based on its financial health and performance. Instead of looking at the stock's current market. Just as the intrinsic value of a business tells how much it would be worth if it were to liquidate and sell everything, the intrinsic value of a share tells. To answer your question, I find Morningstar to be a decent source that can help analyze stocks, it condenses information pretty well. Intrinsic value is the anticipated or calculated value of a company, stock, currency or product determined through fundamental analysis. But what if the strike price is higher than the $ market price of XYZ stock? Let's say the call option strike is $50 ($48 – $50 = –$ The option would. In intrinsic valuation, the value of an asset is estimated based upon its cash flows, growth potential and risk. In its most common form, we use the discounted. If the stock price is higher than the intrinsic value, it may be overpriced and not worth buying (but potentially worth shorting). If the stock is trading. We view intrinsic value as an estimate of what a company is worth today based on expectations of its future growth. The goal is to identify stocks with. Intrinsic value is a measure of what a stock is worth, independent of its current market price. It represents the perceived true value of the stock based on an.

Is the intrinsic value of the stock you are buying lower than the price? Early purchasers of Netscape stock were treated to a harsh lesson in its intrinsic. If the intrinsic value is higher than the actual stock price of the company, then the stock offers an investment opportunity. It's like buying a Rs note. Value investing is an investing strategy that is based on the fundamentals of a company's business rather than the market factors affecting it In simple words. Value stocks are companies that appears to trade at a discount to its intrinsic value based on fundamental data like dividends, earnings, sales and book value. intrinsic value stocks ; 1. Lloyds Metals, , , ; 2. Ashoka Buildcon, , , investing should always be fair value. Many popular books on investing don Wall Street, New York U.S. Stocks Hit Record Highs. Stocks correlated to. For instance, if a stock's intrinsic value is $15 per share but trades at $10, a 35% margin of safety prompts purchasing at $10, safeguarding against potential. To oversimplify, the intrinsic value of a stock could be seen as the correct value of that stock. There is a more technical intrinsic value definition. By that. Benjamin Graham and Warrant Buffett are widely considered the forefathers of value investing, which is based on the intrinsic valuation method. Graham's. Intrinsic value is the anticipated or calculated value of a company, stock, currency or product determined through fundamental analysis. I selected the ten largest companies on the stock market with a return on equity higher than 15% and calculated their respective intrinsic values using. Extrinsic value is made up of time until expiration, implied volatility, dividends and interest rate risks. Intrinsic Value (Calls). A call option is in-the-. High High-growth stocks Stockwire Stock Screeners Stocks at All Time High intrinsic value and buy it only when it's trading below the intrinsic value. stock awards) should be phased in over a number of years so the. CEO will have an incentive to keep the stock price high over time. If the intrinsic value could. Value stocks are companies that appears to trade at a discount to its intrinsic value based on fundamental data like dividends, earnings, sales and book value. If the intrinsic value is higher, the stock is undervalued, and the investor should buy the stock. If the two values are equal, the stock is fairly valued. Which Is The Best Investment For You? If you are interested in investing in a high quality large pharmaceutical company, two of your primary choices would be. Growth stocks are stocks that come with a substantially higher growth rate compared to the mean growth rate prevailing in the market. It means that the stock. Intrinsic Value Investing Evolution Value/Size/Quality: Buy low price to something stocks with a tilt towards small stocks that have a larger implied equity. Intrinsic value is the estimated value of an investments future cash flow, expected growth, and risk. The difference between the current stock price and the.

Honeywell Flour Mills

Honeywell Flour Mills Plc specializes in manufacturing and marketing flour and wheat-based products. The activity is organized around two families of products. Company Name: Honeywell Flour Mills Plc · Headquarters: (View Map). Lagos, Nigeria · Food Production · - 1, employees. Honeywell Flour Mills Plc engages in the manufacture, sale, and market of wheat-based products. It operates through the following segments: Apapa, Ikeja. Due to increased power requirements in , a further JMS GS-NL was added to the fleet of generators at Honeywell Flour Mills. Honeywell Group among the top companies in the country. In , Flour Mills of Nigeria acquired % of Honeywell Flour Mills. Honeywell Flour Mills Plc specializes in manufacturing and marketing flour and wheat-based products. The activity is organized around two families of products. Honeywell Flour Mills Plc (HFMP) is a major flour milling company in Nigeria and was initially registered as Gateway Honeywell Flour Mills Limited in Apr 29, Honeywell Group and Flour Mills of Nigeria Transaction Completion Update. Investments, Foods. Nov 22, Honeywell Group and Flour Mills of. 22K Followers, Following, Posts - Honeywell Flour Mills Plc (@honeywellfoods) on Instagram: "The Official IG Page of Honeywell Semolina. Honeywell Flour Mills Plc specializes in manufacturing and marketing flour and wheat-based products. The activity is organized around two families of products. Company Name: Honeywell Flour Mills Plc · Headquarters: (View Map). Lagos, Nigeria · Food Production · - 1, employees. Honeywell Flour Mills Plc engages in the manufacture, sale, and market of wheat-based products. It operates through the following segments: Apapa, Ikeja. Due to increased power requirements in , a further JMS GS-NL was added to the fleet of generators at Honeywell Flour Mills. Honeywell Group among the top companies in the country. In , Flour Mills of Nigeria acquired % of Honeywell Flour Mills. Honeywell Flour Mills Plc specializes in manufacturing and marketing flour and wheat-based products. The activity is organized around two families of products. Honeywell Flour Mills Plc (HFMP) is a major flour milling company in Nigeria and was initially registered as Gateway Honeywell Flour Mills Limited in Apr 29, Honeywell Group and Flour Mills of Nigeria Transaction Completion Update. Investments, Foods. Nov 22, Honeywell Group and Flour Mills of. 22K Followers, Following, Posts - Honeywell Flour Mills Plc (@honeywellfoods) on Instagram: "The Official IG Page of Honeywell Semolina.

Honeywell Flour Mills PLC historical stock charts and prices, analyst ratings, financials, and today's real-time HONYFLOUR stock price. Honeywell Flour Mills's headquarters is located at 2nd Gate Bye-Pass, Lagos. What is Honeywell Flour Mills's latest funding round? Honeywell Flour Mills's. Complete Honeywell Flour Mills PLC stock information by Barron's. View real-time HONYFLOUR stock price and news, along with industry-best analysis. Honeywell Flour Mills Plc · «Back to Major Corporations. Honeywell Flour Mills Plc. City, Lagos. Phone, + 1 Our Partners. Nigeria Partners. Find company research, competitor information, contact details & financial data for HONEYWELL FLOUR MILLS PLC of Lagos, Lagos. The Official IG Page of Honeywell Semolina. Nigeria's No. 1 Semolina Brand. Appreciate Every Mouthful. Order your Combo packs here. Salaries by job title at Honeywell Flour Mills ; Maintenance Engineer · NGN K-NGN 1M. NGN K | NGN K ; Miller · NGN 3M-NGN 4M. NGN 4M | NGN 0 ; Procurement. Honeywell Flour Mills is a flour milling company that manufactures and markets wheat-based products. Apr 29, Honeywell Group and Flour Mills of Nigeria Transaction Completion Update. Investments, Foods. Nov 22, Honeywell Group and Flour Mills of. Honeywell Flour Mill Plc, a food products company in the consumer goods sector, announced % revenue growth in Q3 Results. Honeywell Foods, Lagos, Nigeria. likes · talking about this. Honeywell Flour Mills Plc is a leading and highly successful indigenous. Nigerian Federal High Court finds bank liable after mill's assets were frozen in Flour Mills of Nigeria facility. Honeywell Flour Mills sustains loss on. Honeywell Flour Mills PLC is a Nigeria-based company. It is engaged in the manufacturing of wheat-based products such as flour, semolina, whole wheat meal. Established in , Honeywell Group is a holding company investing in critical sectors of the Nigerian economy. Nigerian Federal High Court finds bank liable after mill's assets were frozen in Flour Mills of Nigeria facility. Honeywell Flour Mills sustains loss on. HONYFLOUR | Complete Honeywell Flour Mills PLC stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Honeywell Flour Mills Plc. currently operates capacity of 48 per cent but the additional , tons to be generated on the completion of the factory by Q1. Home. Shorts. Library. Honeywell Flour Mills Plc. @honeywellflourmillsplc subscribers•28 videos. More about this channel more more. Subscribe. Honeywell Flour Mills's headquarters is located at 2nd Gate Bye-Pass, Lagos. What is Honeywell Flour Mills's latest funding round? Honeywell Flour Mills's. 22K Followers, Following, Posts - Honeywell Flour Mills Plc (@HoneywellFoods) on Instagram: "The Official IG Page of Honeywell Semolina.

Aerin Lauder Net Worth

Lauder family. $B. America's Richest Families Net Worth. as of 2/8/ aerin lauder jack zinterhofer Aerin Lauder Zinterhofer Net Worth aerin lauder jack zinterhofer. Aerin Lauder Net Worth & Biography: Net Worth of Aerin Lauder is $ Billion. She is ranked # on the real-time Billionaires list. Check Aerin Lauder's. worth shipping back to Doha to replace the ones so unceremoniously taken Aerin Lauder in Vogue, via Habitually Chic, 9. Katie Ridder via Galbraith. Kyra Sedgwick ($16 Million) · Armie Hammer ($16 Million) · Paris Hilton ($ Million) · Anderson Cooper ($ Million) · Aerin Lauder ($3 Billion) · Balthazar Getty. Was it the most expensive jewel ever worn to the Academy Awards? Worth a reported. $30million, it's likely that Lady Gaga's Tif- fany diamond necklace claims. As a major shareholder in the $32 billion international cosmetics giant, Ms. Lauder has built up her personal net worth to an estimated $ billion. Estée. A sister, aerin lauder, is also a billionaire, though her net worth is below the ranking's current $4 billion cutoff. There is one sister in the family. The estimated net worth of Aerin Lauder is at least $, dollars as of Aerin Lauder is the Director, 10% Owner of The Estee Lauder Companies Inc. Lauder family. $B. America's Richest Families Net Worth. as of 2/8/ aerin lauder jack zinterhofer Aerin Lauder Zinterhofer Net Worth aerin lauder jack zinterhofer. Aerin Lauder Net Worth & Biography: Net Worth of Aerin Lauder is $ Billion. She is ranked # on the real-time Billionaires list. Check Aerin Lauder's. worth shipping back to Doha to replace the ones so unceremoniously taken Aerin Lauder in Vogue, via Habitually Chic, 9. Katie Ridder via Galbraith. Kyra Sedgwick ($16 Million) · Armie Hammer ($16 Million) · Paris Hilton ($ Million) · Anderson Cooper ($ Million) · Aerin Lauder ($3 Billion) · Balthazar Getty. Was it the most expensive jewel ever worn to the Academy Awards? Worth a reported. $30million, it's likely that Lady Gaga's Tif- fany diamond necklace claims. As a major shareholder in the $32 billion international cosmetics giant, Ms. Lauder has built up her personal net worth to an estimated $ billion. Estée. A sister, aerin lauder, is also a billionaire, though her net worth is below the ranking's current $4 billion cutoff. There is one sister in the family. The estimated net worth of Aerin Lauder is at least $, dollars as of Aerin Lauder is the Director, 10% Owner of The Estee Lauder Companies Inc.

Cosmetics Heir Jane Lauder Joins World's Richest People · Lauder's net worth rose $ billion this year, bringing her fortune to $ billion. 20 August. Estee Lauder Companies reports profit in is fourth quarter ended June 30; net income Aerin Lauder, 28, is hyperactive member of New York's junior. Fiscal has been adjusted for a charge to remeasure net monetary assets Lauder, Aerin Lauder, Jane Lauder, certain Family Controlled Entities and. Prominent philanthropist and American businessman Ronald Lauder has an estimated net worth of $ billion as of April , according to Forbes. Who is Aerin Lauder? Aerin Lauder has an estimated net worth of $ Million. This is based on reported shares in ESTEE LAUDER COMPANIES INC. According to Forbes, Lauder has a net worth of $ billion dollars as of September (number on Forbes' list of billionaires). Both in executive positions at their late grandmother's company, Estée Lauder, the Bloomberg Billionaires Index has determined each woman's net worth to be. Aerin Lauder Zinterhofer Net Worth Posted on July 23, | 1 minutes | 66 words | Chauncey Koziol. In , Lauder married Eric Zinterhofer in a. Cosmetics Heir Jane Lauder Joins World's Richest People · Lauder's net worth rose $ billion this year, bringing her fortune to $ billion. 20 August. Was it the most expensive jewel ever worn to the Academy Awards? Worth a reported. $30million, it's likely that Lady Gaga's Tif- fany diamond necklace claims. Wealth History ; , 2,,, ; , 3,,, ; , 3,,, ; , 3,,, Aerin Lauder Net worth: $ billion. Lauder is the sister of Jane Lauder another fellow rich woman. Yes, she is richer than her sister, but that's because. Aerin Lauder Zinterhofer Grat Net Worth and insider trades, trade reports, independent equity research, and stock screening. about aerin, aerin lauder, style # Aerin Lauder Zinterhofer Follow (3) Real Time Net Worth As of 3. Aerin. With consumer sentiment so pessimistic, it was no surprise that Lauder's sales fell 7% last year, while net income tumbled 54%. For Estée Lauder, Aerin Lauder. As of December the family net worth is estimated at $33 billion. NET A PORTER shop, 9 to 5 Dress Code Est e Lauder and Aerin s Aerin aerin lauder bet worth · aerin lauder billionaires · aerin lauder birthday · aerin. Estee Lauder Companies reports profit in is fourth quarter ended June 30; net income Aerin Lauder, 28, is hyperactive member of New York's junior. Aerin lauder zinterhofer shop wikipedia. Family tree of Aerin Lauder Geneastar shop, Aerin Lauder Net Worth Wedding Age House shop, Aerin Lauder Alchetron The. Ronald Steven Lauder, Estée Lauder heir with a $ billion net worth, extends beyond the cosmetic empire into defense, diplomacy, and diverse philanthropy.

West Texas Crude Oil Stock Symbol

Crude oil prices today - okatiev.ru · Home · Oil Prices · Oil Futures · Rig Count West Texas Intermediate, , , %(3 days Delay), (3 Days Delay). The current price of West Texas Intermediate (WTI) crude oil today is $ per barrel. Live charts, historical data, futures contracts, and breaking news. Oil Price: Get all information on the Price of Oil including News, Charts and Realtime Quotes Oil (WTI) Price. %. PM EDT 9/6. See the very latest US Light Crude oil price data and sentiment and spot trading opportunities. US Light Crude is one of our most frequently traded. Get Crude Oil Front Month Futures (CLc1) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. The West Texas Intermediate Light Sweet Crude Oil futures contract is cash settled against the prevailing market price for US light sweet crude. It is a. Find the latest Crude Oil Oct 24 (CL=F) stock quote, history, news and other vital information to help you with your stock trading and investing. Company profile for Crude Oil WTI (CL*0) including business summary, key statistics, ratios, sector. View the latest Crude Oil WTI (NYM $/bbl) Front Month Stock (CL.1) stock price, news, historical charts, analyst ratings and financial information from WSJ. Crude oil prices today - okatiev.ru · Home · Oil Prices · Oil Futures · Rig Count West Texas Intermediate, , , %(3 days Delay), (3 Days Delay). The current price of West Texas Intermediate (WTI) crude oil today is $ per barrel. Live charts, historical data, futures contracts, and breaking news. Oil Price: Get all information on the Price of Oil including News, Charts and Realtime Quotes Oil (WTI) Price. %. PM EDT 9/6. See the very latest US Light Crude oil price data and sentiment and spot trading opportunities. US Light Crude is one of our most frequently traded. Get Crude Oil Front Month Futures (CLc1) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. The West Texas Intermediate Light Sweet Crude Oil futures contract is cash settled against the prevailing market price for US light sweet crude. It is a. Find the latest Crude Oil Oct 24 (CL=F) stock quote, history, news and other vital information to help you with your stock trading and investing. Company profile for Crude Oil WTI (CL*0) including business summary, key statistics, ratios, sector. View the latest Crude Oil WTI (NYM $/bbl) Front Month Stock (CL.1) stock price, news, historical charts, analyst ratings and financial information from WSJ.

WTI crude oil futures fell % to settle at $ per barrel on Friday, marking their lowest level since June , as OPEC+ struggled to ease market. Cushing, OK WTI Spot Price FOB (Dollars per Barrel). Week Of, Mon, Tue, Wed, Thu, Fri. Dec to Jan- 3 Spot Prices for Crude Oil and Petroleum Products. Price, Change, %Change, Contract, Time (EDT). CL1:COM. WTI Crude Oil (Nymex). USD/bbl. , , %, Oct , 9/6/ CO1:COM. Brent Crude (ICE). USD. Two major benchmarks for pricing crude oil are the United States' WTI (West Texas Intermediate) and United Kingdom's Brent. The differences between WTI and. WTI Crude (Oct'24) CLCV1:New York Mercantile Exchange · Open · Day High · Day Low · Prev Close · 10 Day Average Volume, · Open Interest. WTI Oil. cfd. CL. Open. Follow · (%). in:USD As of: Sep 06, UTC. Interactive chart showing the daily closing price for West Texas Intermediate (NYMEX) Crude Oil over the last 10 years. The prices shown are in U.S. West Texas Intermediate (WTI) and Brent Crude: What's the difference between these two global crude oil benchmarks? So, you've thought about trying your. WTI Crude Oil Spot Price is the price for immediate delivery of West Texas Intermediate grade oil, also known as Texas light sweet. It, along with Brent Spot. West Texas Intermediate (WTI) is a grade or mix of crude oil; the term is also used to refer to the spot price, the futures price, or assessed price for. Updated Price for Crude Oil WTI (NYMEX: CLV24). Charting, Price Performance, News & Related Contracts. Crude Oil WTI Futures - Oct 24 (CLV4) ; Settlement Day: 09/19/ ; Last Rollover Day: 08/17/ ; Tick Size: ; Tick Value: 10 ; Base Symbol: T. Find the latest W&T Offshore, Inc. (WTI) stock quote, history, news and other vital information to help you with your stock trading and investing. Two major benchmarks for pricing crude oil are the United States' WTI (West Texas Intermediate) and United Kingdom's Brent. Spot Crude Oil Price: West Texas Intermediate (WTI) (WTISPLC). Download. Aug | Dollars. Current West Texas Intermediate Crude Oil (WTI) Prices ; 08/30/24, $ ; 08/29/24, $ ; 08/28/24, $ You've probably heard people quote the price of. “West Texas Intermediate” or “Brent” oil in news or business reports. Although these price benchmarks have. the CL.1 futures and commodity market news with real-time price data for better-informed trading Exxon Stock Drops as Oil Prices Fall. Blame OPEC. NYMEX WTI Crude and NYMEX RBOB Gas. Gasoline prices are impacted by crude oil price changes and can be traded with RBOB futures or RBOB as a spread to WTI. Crude Oil Prices: West Texas Intermediate (WTI) - Cushing, Oklahoma (DCOILWTICO). Download.